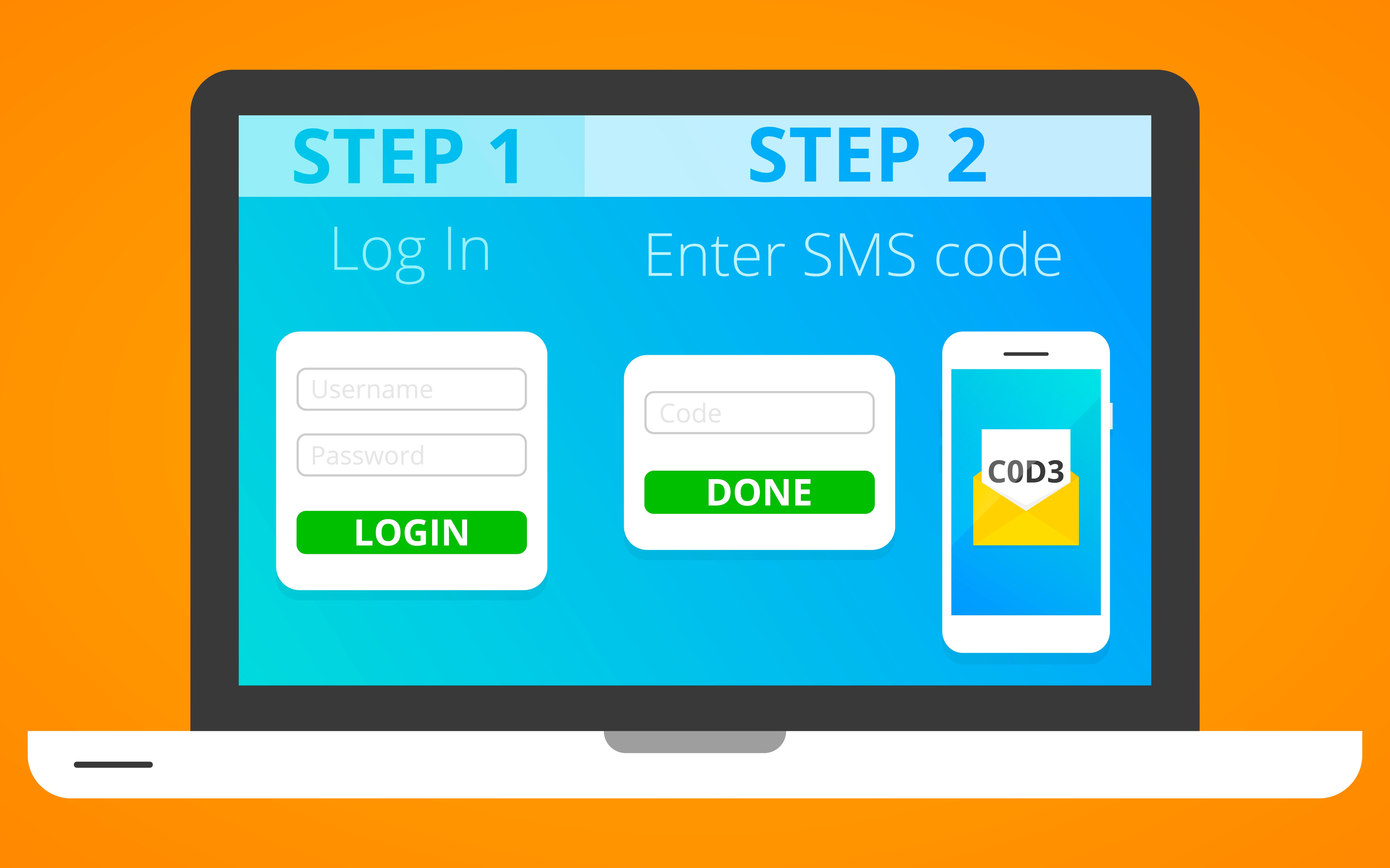

As data security professionals, it's clear to us why mortgage companies should be using multi-factor authentication (MFA) in their businesses. Yet many mortgage firms are still resistant to adopting this technology for fear that it will only complicate processes and slow productivity. However, the benefits of this added security far outweighs the additional effort it requires.

-1.png?width=142&name=ABT-Logo_2016%20(transparent)-1.png)