Connect Core Banking Systems, LOS, and Servicing Systems With Ease

ABT's DataExchange® works, so you don’t have to. Connect and smart transfer data between core banking, mortgage, imaging, servicing, sub-servicing, CRM, and other industry systems.

Encrypt sensitive data in transit and at rest.

Smart interfaces that connect to any software platform API.

Manually typing data between your LOS, core, and servicing platforms is painful, costly, and a liability.

ABT partners with dozen of industry platforms, eliminating the need to retype data and fix errors.

Loan Origination System:

Byte Pro

Calyx Path

Calyx PointCentral

ICE MT Encompass

Integra Epic Mortgage

MeridianLink Consumer (formerly LoansPQ)

Mortgage Cadence LFC

Mortgage Cadence MCP*

MortgageFlexONE

OpenClose LenderAssist

Temenos Infinity

Data Warehouse:

Mortgage BI®

*coming soon

Core:

Corelation Keystone

Finastra Fusion Phoenix

Finastra Fusion UltraData

FIS Bankway

FIS Horizon XE

Fiserv Data Safe

Fiserv DNA

Fiserv Precision

Fiserv Premier

Fiserv Spectrum

Fiserv XP2

Jack Henry Silver Lake

Jack Henry Symitar Episys

Specialty:

Fiserv WireExchange

MeridianLink Opening (formerly XPressAccounts)

CRM:

ICE MT Velocify

Total Expert

Imaging:

Jack Henry Symitar Synergy

Servicing Platform:

FICS Mortgage Servicer

Finastra Fusion Servicing Director

Sub-servicing:

Cenlar MSP

Dovenmuehle DMI

TruHome

Worry-free Interface

Trusted by leading peers:

A Partner You Can Trust

Experienced and Proficient

Budget-Minded

DataExchange Core and Options

-

Core Loan Data (foundation)

The Core Loan Data foundation moves all 1st lien position data into the client's core banking system, mapped to the corresponding field.

-

New Member (option)

At the time of funding, the New Member module checks the core banking system for borrower and co-borrower records. When not found, the module adds the missing contacts to the system.

-

Monetary - General Ledger (option)

The Monetary or General Ledger module transfers selected origination and loan fees from the loan origination system and post the fees to specific chart of account numbers on your general ledger.

-

Escrow (option)

The Escrow module gathers all escrow-related data of all loan programs and populates the corresponding data sets within the client’s core banking platform.

-

HELOC and Seconds (option)

HELOC and second loan data input is time-consuming. This module moves all key HELOC and second loan data elements into the client’s core banking system fields.

-

Wire Transfer (option)

The Wire Transfer module starts the data delivery from your loan management platform, and moves all key information to your wire transfer system of choice for review, verification, and the eventual upload into the FRB Fedwire system.

-

Custom (option)

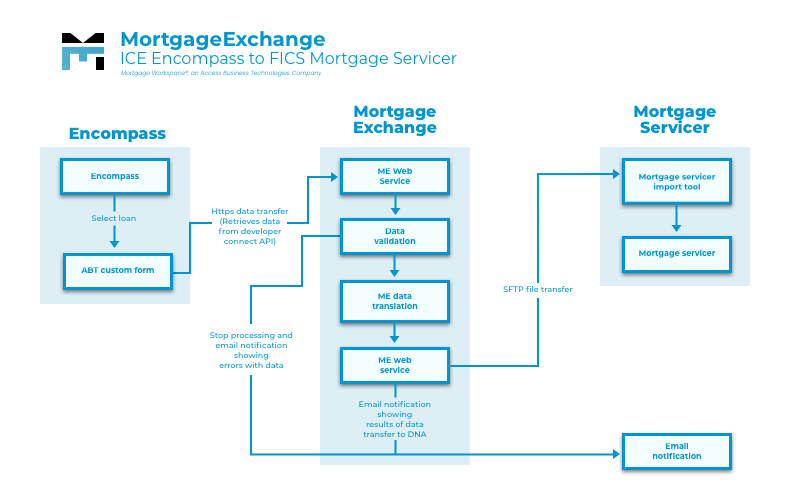

We listen, take notes, ask questions, and return a custom statement of work for the interface of your choice. We prefer building the MortgageExchange connections using the source or target platform's API. However, when not available, we will custom code the transfer method in and out of MortgageExchange.

You're Tired of Manual Data Entry Errors Between Your Connected Systems. Right?

The heart of DataExchange contains advanced workflow and rules-based validation. DataExchange is an advanced export, transport, and load (ETL) middleware platform - a transport layer with no capacity to store data. Data remains secure in transit and at rest. Using the source and target platform API, SDK, or custom code, we connect your systems and eliminate interface management pain and cost.

Getting started with DataExchange is as easy as 1, 2, 3...

Talk with an expert and discuss your data transfer needs

Our team will build, test, and deploy your connections

Enjoy a worry- and error-free connection that just works

Every loan officer should have this. Even though I have a secure website I have my clients upload documents to, they have to sign in and create a password. I still have renegade clients that just email to me and I can't control them from doing it. This way, it is as easy for them as email.

FAQ

-

Are you able to connect to systems not listed on the DataExchange website?

Yes. Most of the time, we have access to an API (application programming interface) or an SDK (software development kit). As long as the systems allow a way to connect, we can build the interface.

-

How long does it take to build my DataExchange connection?

A typical DataExchange project takes about 90-days. Time can vary based on client needs and availability of subject matter experts on your team.

-

What if we need to delay our project due to other internal projects?

No problem. If your priorities shift, we can work with you.

-

How do you insure delivery of our interface within the proposed budget?

We work with our clients to document the interface needs and define the project scope. When the project plan remains within scope with the signed agreement, we deliver on budget.

-

How much time do we need to allocate for our team as you build the interface?

We bear most of the development work. With subject matter experts on your team, we can limit your team involvement during the development phase. Our team will coach and consult with your team as we work together.

-

How do you deploy interface modifications?

We build each DataExchange with production and development instances. We always develop in the sandbox and push changes to production after testing and approval.

-

What if I want to make changes after you deploy DataExchange?

We accommodate client modifications and only charge the development time required to build and test the new features.

-

Who supports DataExchange after deployment?

We are responsible for hosting and managing your DataExchange instance, delivering a worry-free experience for your team.

-

What type of data can we connect between our systems?

We build each interface based on your connection requirements. Most of the time, we have access to an API (application programming interface) or an SDK (software development kit). As long as the systems allow a way to connect, we can build the interface.